Dark mode Light mode. Some people buy and hold assets for decades to defer tax payments. However, this decision also triggers capital gains taxes. Trading and exchanging assets on a cryptocurrency exchange leads to short-term capital gains.

The domain name bitcoinscene.shop is for sale. Make an offer or buy it now at a set price. Visit bitcoinscene.shop to see hundreds of companies and stores that accept Bitcoin and other top crypto. Find all of the best places where you can spend crypto.

Read More

22 top Cryptocurrency companies and startups in Israel in � GK8 � DeepDao � Platin Ltd � Flambu � SolarChange � 2key � bitcoinscene.shop � Exberry. As technology adoption in Israel is fast, a lot of the population is actively using cryptocurrencies to trade, invest in ICOs and purchase goods and services.

Read More

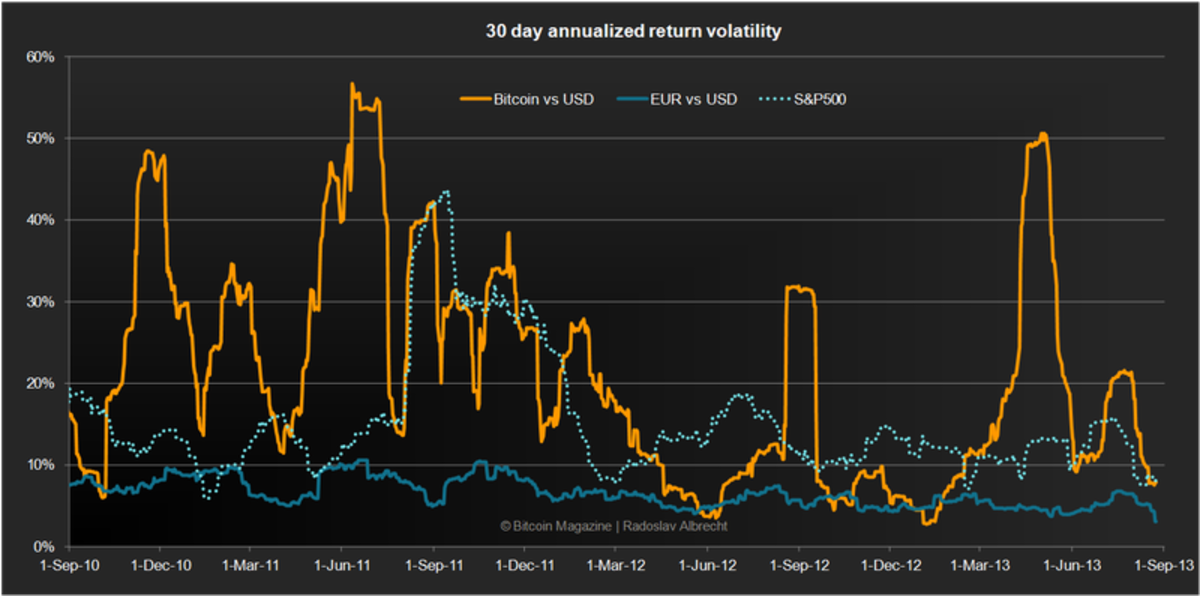

Cryptocurrencies are in general highly volatile, and are subject to sudden, massive price swings. Therefore, the analysis of Bitcoin volatility and the factors. Volatility affects prices and thus the demand for Bitcoin; demand can be a real demand for Bitcoin used in physical transactions or a speculative demand where.

Read More

Another option to buy the Original Crypto Coin is through a decentralized exchange (DEX) which supports the blockchain where your Original Crypto Coin resides. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates.

Read More

The core difference between APR and APY lies in compounding interest rates. APY takes compounding interest into account, while APR does not. APY takes into account the extra interest earned and gives a better return on investment overall. With each passing year, the amount of interest a person.

Read More

The ML Bluetec has a liter turbodiesel V6 that utilizes state-legal clean-diesel technology. It produces hp and a prodigious lb-ft of torque. Engine and Transmission � Engine. L Turbo V6 Diesel � Horsepower. hp @ rpm � Torque. @ - � Transmission. 7-Speed Automatic.

Read More

The price of BOB Token (BOB) is $ today with a hour trading volume of $1,, This represents a % price increase in the. BOB (BOB) is currently ranked as the # cryptocurrency by market cap. Today it reached a high of $, and now sits at $ BOB (BOB) price is up.

Read More

BTC and LTC both use a Proof of Work consensus method for adding new transaction blocks to their respective blockchains, but they use different. BTC is the cryptocurrency symbol. LTC is a cryptocurrency symbol. 5. Satoshi is the cryptocurrency used. Litoshi is the cryptocurrency used. 6.

Read More

"Bitcoin is exciting because it shows how cheap it can be," the self-made billionaire told Bloomberg in Bitcoin spent the rest of the year gradually declining and closed at about $ The year started with Bitcoin declining, but most of.

Read MoreCashing out cryptocurrency to fiat currency is considered a disposal subject to capital gains tax. The two types are short-term and long-term capital gains and are based on how long you hold the asset, in this case, the cryptocurrency. Additionally, any gains on your cryptocurrency before moving and establishing bona fide residency in Puerto Rico are still taxable in the United States at the applicable tax rates. Capital gains: If you dispose of your cryptocurrency, your profits will be subject to capital gains tax. The IRS views mined crypto as ordinary income. We teamed up with Koinly to bring you a quick and easy solution: a tool to create crypto tax reports. However, if you receive a crypto gift, you should keep records that detail the value of your gift at the time you acquired it.