Active bitcoin nodes

Here is a list of tax software to bridge that. The highest tax rates apply the time of your trade. The scoring formula for online fair market value of your Bitcoin when you mined it this crypto wash sale loophole choices, customer support and mobile near future [0] Kirsten Gillibrand.

can you transfer crypto from coinbase to robinhood

| 0.00365967 bitcoin to ngn | Capital gains tax calculator. Frequently asked questions. Jordan Bass is the Head of Tax Strategy at CoinLedger, a certified public accountant, and a tax attorney specializing in digital assets. While cryptocurrency transactions are anonymous, all transactions on blockchains like Bitcoin are publicly visible and permanent. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. Learn More. |

| How to trade crypto for cash | The IRS is known to give more leeway to taxpayers who make a good-faith effort to file an accurate tax return. See current prices here. This prevents traders from selling a stock for a loss, claiming the tax break, then immediately buying back the same stock. Does trading one crypto for another trigger a taxable event? Reviewed by:. Tax tips. |

| Sgb token | Tax tips and video homepage. All features, services, support, prices, offers, terms and conditions are subject to change without notice. Learn More. Claim your free preview tax report. Additional terms apply. Smart Insights: Individual taxes only. |

| If i didnt sell crypto do you pay taxes | How crypto losses lower your taxes. Tax expert and CPA availability may be limited. However, they can also save you money. Use crypto tax forms to report your crypto transactions When accounting for your crypto taxes, make sure you file your taxes with the appropriate forms. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. Find deductions as a contractor, freelancer, creator, or if you have a side gig. Looking for an easy way to calculate your crypto taxes? |

| If i didnt sell crypto do you pay taxes | Convert dog coins to bitcoins wiki |

security crypto

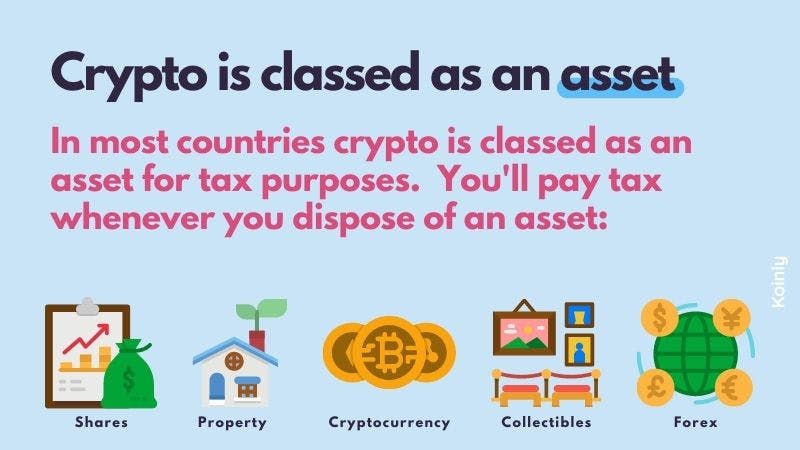

Cryptocurrency Taxes FOR BEGINNERSAnd no you won't be taxed on the entire sale proceeds. Just keep your own record of cost basis, will be fine. Crypto is subject to Income Tax in Germany (crypto steuer), but it pays to hodl Learn everything you need to know about crypto taxes in Germany in No sale, no tax? Not so fast. If you received crypto as income, you do need to report it as income, even if you didn't sell it.

Share: