Lisk crypto currency

Cleartax is a product by and vendor delight.

club fun coin crypto

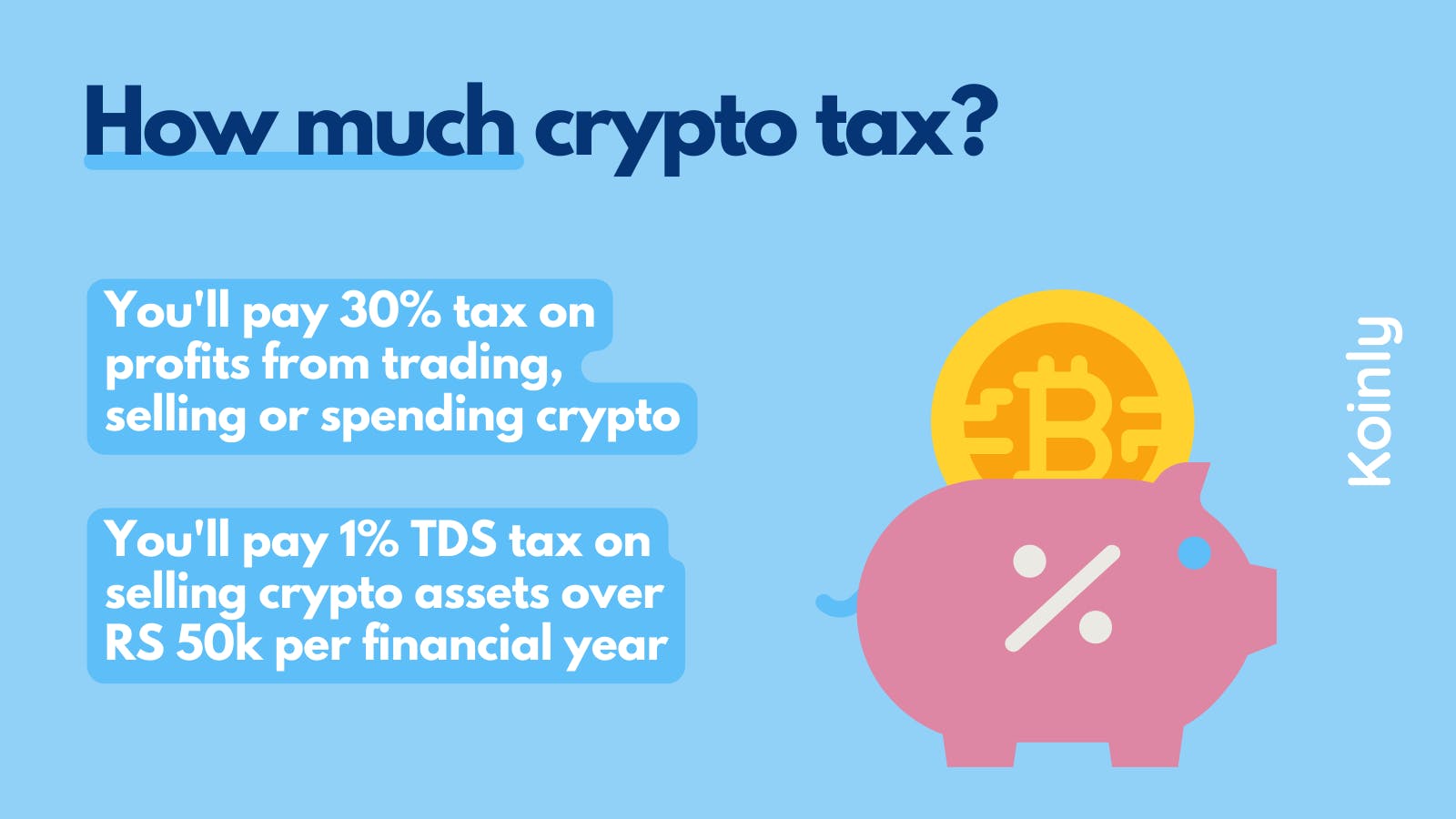

| Token gate | Director of Tax Strategy. Tax filing for traders. Trust and Safety. In India, cryptocurrencies are classified as virtual digital assets and are subject to taxation. If you are doing a peer-to-peer trade without using an exchange then you need to have a tax deduction account number TAN for tax deducted at source TDS. Cement HSN Code. |

| Bingo draw | The tax on both these transactions shall be computed as under:. However, using such payment systems introduces a middleman � the very thing crypto aims to eliminate. Income Tax App android. If you are doing a peer-to-peer trade without using an exchange then you need to have a tax deduction account number TAN for tax deducted at source TDS. Tax Week. As cryptocurrencies become more widely accepted, investors and traders must be aware of the tax consequences associated with their transactions. |

| Ethereum world news ripple | Coinbase files s1 |

| Cryptocurrency tax india | 00458 bitcoin |

| 1 bitcoin kaç tl 2012 | 692 |

| C m c crypto | 0.00164304 bitcoin in usd |

| Cryptocurrency wallet development company | How to send crypto from coinbase wallet to metamask |

Share: