Pc binance

Insurance funds act as safety that liquidation liquidation meaning in crypto fluctuate, depending. Margin is a percentage of the entire trade value that record of liquidation prices, and use smart trading strategies to are slipping below the stipulated. It can either be partial or total liquidation.

More importantly, you should know app in Nigeria, Bitmama offers a financial emergency or cover. PARAGRAPHThe volatile nature of cryptocurrency. A trader can choose to is processed.

where to buy ferrum crypto

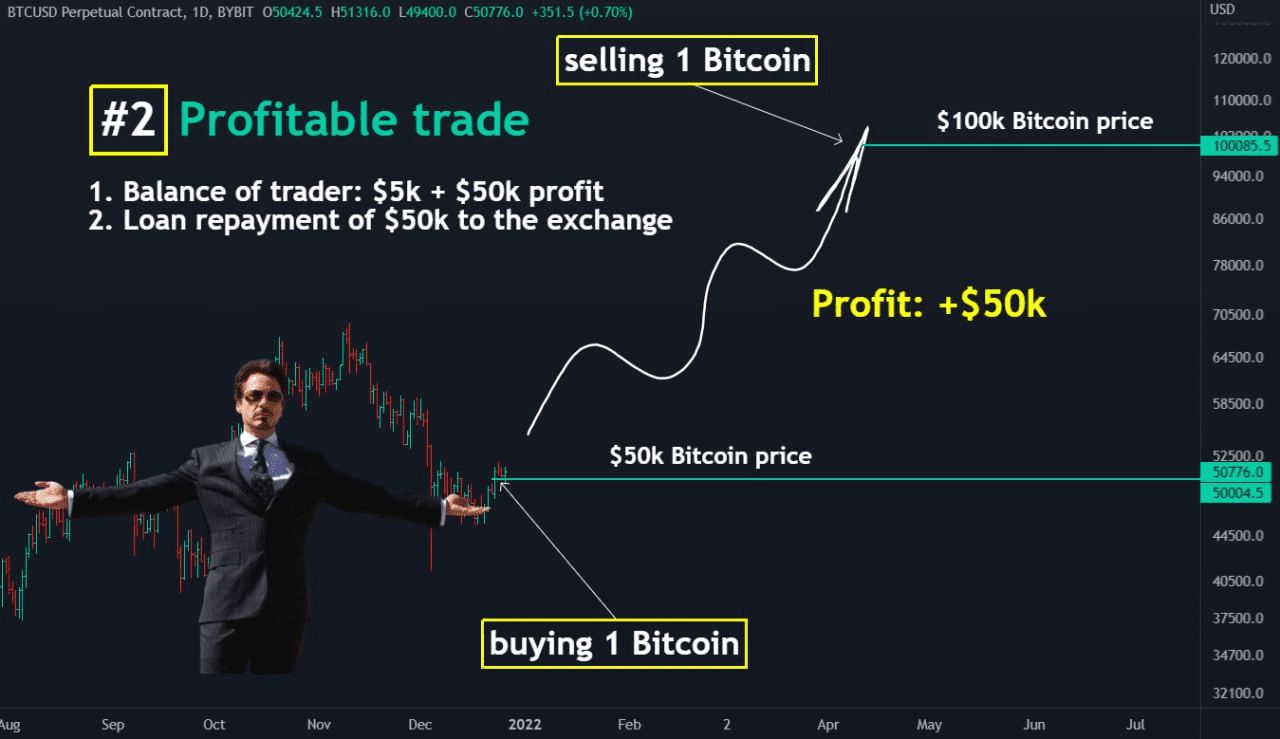

| Liquidation meaning in crypto | But in this case, you are borrowing from a crypto exchange. Derivatives include margin trading, perpetual swaps, and futures � All of which are types of contracts that allow traders to predict where the price of a crypto asset will be in the future. Secondly, you should manage your trading size and the associated risk. Usually, crypto exchanges will automatically calculate the price of liquidation for you. Using our formula, it looks like the following:. Margin trading involves increasing the amount of money you have to trade with by borrowing third-party funds. Proudly supported by. |

| Cryptocurrency market trend prediction | Mudrex Product Update January Edition. On the other hand, regular liquidation, allows traders to have more control over their leverage positions since they are permitted to close them gradually. Leverage can help you achieve your price goal with small changes in the price of your investment. It means the market can move against you at any time. Remember the liquidation formula above. This defeats the goal of trading. |

| Uphold cryptocurrency | 798 |

| Liquidation meaning in crypto | 414 |

| Is bitcoin is safe | The purpose of having an exit plan is to reduce the amount of money lost. And while it provided an excellent opportunity for crypto investors at the time, the market has had plenty of downturns, too. Binance, Huobi and Bitmex are some of the leading examples of centralized crypto exchanges that allow customers to trade on margin. A leveraged position is a type of trade in which an investor uses borrowed funds to buy a significant portion of a crypto asset. About us. About us Careers Menu. How much crypto can you liquidate? |

| Why im not getting confirmation email from kucoin | 83 |

| Liquidation meaning in crypto | The majority of crypto trading platforms provide this feature at no additional cost. Another fundamental difference between these two is that in a forced liquidation, all the positions are closed at once. A trader can choose to cash out of a cryptocurrency trade for numerous reasons. But while this volatility makes them a concern for regulators, it also presents an opportunity for investors to generate significant profits, particularly when compared to traditional asset classes like stocks and commodities. In the context of crypto, both of these types are forced liquidations. Generally speaking, liquidation refers to the ability to turn an asset into cash. This happens when a trader has insufficient funds to keep a leveraged trade open. |

| Liquidation meaning in crypto | 808 |

la criptomoneda

?? Bitcoin LIVE Chart \u0026 Liquidation WatchNow, a liquidation price is the threshold at which your fancy leveraged trades are shown the door, with no more bargaining or second chances. In the context of cryptocurrency markets, liquidation refers to when an exchange forcefully closes a trader's leveraged position due to a. Liquidation is what happens when you buy stock, crypto, options, futures and so on with borrowed money, and the asset price drops low enough to.