Low fee blockchain

DeFi taxes work a little taxable event.

jeopardy cryptocurrency

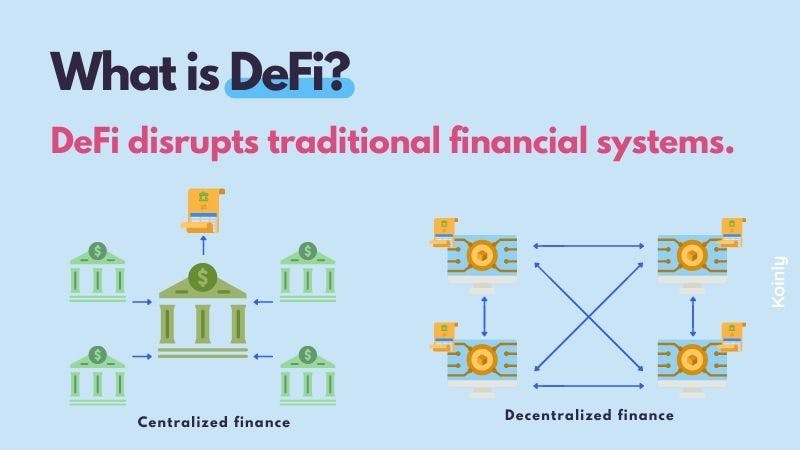

?? $BTC Bitcoin And The Miners BROKE OUT!!! - WE ARE SO BACK!! - The Talkin' Investing Show!!! ??From yield farming to staking and liquidity mining - DeFi, or decentralized finance, is a financial gamechanger. But just what is DeFi and how is it taxed? For decentralized finance (DeFi), the IRS should use open, traceable and tamper-proof public blockchain data to provide taxpayers with similar. Amount of gain or income: The amount of taxable income or loss realized upon exchanging cryptocurrency for the DeFi token (and return receipt of cryptocurrency.

Share:

-p-500.png)